How do I manage interest rates on debt?

Please rotate your device for the best experience.

Transcript

Managing Extreme Interest Rates

Interactive Video

[A man sitting at his kitchen table with his head in his hands peering down at a calculator that is on top of a stack of bills.]

[On screen text]: Credit Card Statistics

Narrator: Check out these statistics from WalletHub and Experian about credit cards [statistics appear on screen as they are announced]:

- Total United States credit card debt:: $100 billion

- Average card balance: $6,000

- Average annual interest fees paid: $600

- Average credit card interest rate: 22 percent

[On screen text]: 22%

Did you catch that interest rate?!? That’s 22 cents for every dollar you pay in interest on your balance.

[22 cents above a $1 bill.]

[A man sitting at his kitchen table with his head in his hands peering down at a calculator that is on top of a stack of bills.]

Interest on credit card debt is among the highest rates charged to consumers.

[On screen text]: Consumer interest rates

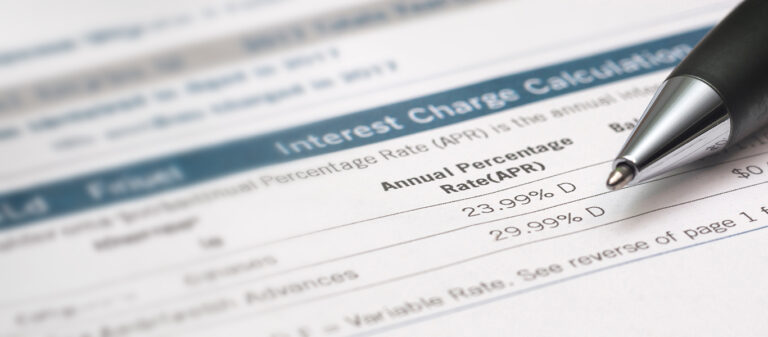

Some credit card interest rates are as high as 36 percent APR!

[Animated credit card statement.]

If you carry a balance on your credit card, it’s akin to borrowing money with high fees. [A pop-up appears with “Balance: $2,309” and “Fees Charged: $78.”] The total interest you end up paying back depends on how long it takes you to pay off the balance. [Picture of a calendar with a clock appears.]

[A woman holding several credit cards.]

And unlike a loan that has fixed payments, credit card debt is revolving. That means you can keep adding to the balance by charging more to your card.

[On screen text]: revolving debt

[Animated credit card with a revolving debt icon.]

Revolving debt can spin up into a money monster if you don’t manage it wisely. [A growing pile of money that turns into a money monster.]

[On screen text]: Interest rates can vary

[Three credit cards lying on top of each other]

Credit card interest rates can vary greatly. Most rates today range from the high teens up to 30-plus percent. [“18%” with an arrow pointing up to “36%.”]

[A credit report with an excellent score of 765.]

Those rates are generally determined by your creditworthiness. Lenders look at your credit score, credit history, income, and outstanding debt to determine your interest rate.

[A young man holding up his credit cards with an expression of excitement on his face.]

Even people with excellent credit scores get 18 to 20 percent interest rates on current credit card offers.

[Text appears: “excellent credit” with an arrow pointing to “18% to 20% interest rates.”] Credit cards are an expensive commitment!

[A person sitting at a laptop with a special offer for a credit card at 0%.]

And don’t be fooled by introductory 0 percent or low-percentage interest rate offers. They’re designed to lure you to apply for a new card. After a specified period of time, the interest rate will jump up in line with other credit cards.

[A balance scale with the interest rate of 27% on one side and cash for the monthly payments on the other side. The 27% interest swings the scale to show it is greater than the monthly payments.]

Also remember: A high interest rate tacks on significant fees if you’re making only small payments. You want your balance to go down, not up! [Small amounts of cash are added to the payment side of the scale though the interest is still greater than the payments.]

[A woman standing beside a mechanic while he holds a clipboard and papers along with the woman’s credit card.]

So, how do you manage these high interest rates? It’s all about having a plan for how and when to use a credit card.

[On screen text]: Devise a plan

Know what you’re getting into and devise a plan to pay off the balance fast.

- If you get a good introductory offer, divide up the payments to pay off the balance before the promotion period is over. [Tag is added to credit card, “0% interest for 3 months.” Three stacks of money are added.]

- Pay more than the minimum payment. Allocate as much as you can monthly to pay down the balance fast. [More money is added beside each of the stacks of money.]

- Use credit cards as a last resort, not a primary payment method. No one is getting outrageously low interest rates. Credit cards come with a costly price tag if not used carefully.

[A three-page long credit card agreement that shows zero percent interest for the first 12 months in fine print.]

And make sure you read the fine print. No one wants to read it, because it’s legalese and it’s long! But the devil’s in the details; you have to decipher what you’re getting into.

[A magnifying glass hovering over the document, examining it. The text appears, “0% interest for 12 months.”]